For over 30 years, the internet has been great at moving information but not money. We can send messages across the world in seconds, but paying for a song, a file, or an API call still feels stuck in another era.

We’ve layered on endless fixes, ads, paywalls, subscriptions, and checkout pages, but none of them truly belong to the web’s original design. The web speaks HTTP, and while HTTP has codes for everything (200 for OK, 404 for Not Found), one status code has always been… empty. 402: Payment Required. It’s been waiting since 1992 for someone to give it meaning. The x402 protocol, introduced by Coinbase and the x402 Foundation, revives the long-dormant HTTP status code 402 (Payment Required) and gives it real purpose. Built as an open, blockchain-agnostic standard, x402 enables instant, programmable payments directly over HTTP, creating a bridge between the traditional web and the emerging machine-driven, value-centric internet.

What is x402?

Basically, x402 is an open protocol that integrates payments into standard web interactions. It allows websites, APIs, and services to request and receive payments seamlessly, without requiring logins, subscriptions, or centralized processors.

At its core, x402 transforms the way a client (human or device) pays for access to a resource online. When a payment is required, the server responds with an HTTP 402 status and payment details. The client then processes the transaction, typically using stablecoins such as USDC, and resubmits the request with proof of payment.

Because it operates within the familiar HTTP framework, x402 can be implemented with minimal changes to existing infrastructure, making it an elegant upgrade path for developers.

How does x402 work at the protocol level?

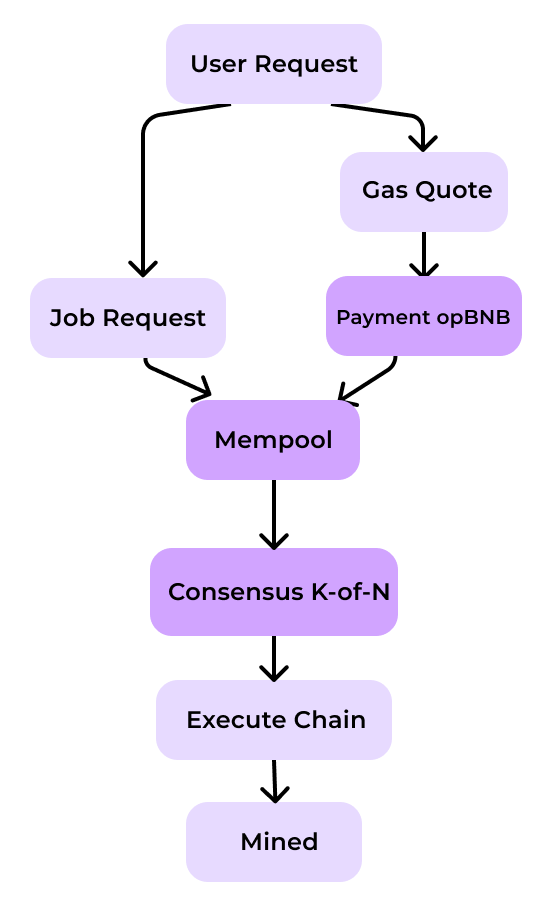

Here’s a simplified outline of how the protocol functions in practice:

- A client (user or device) requests access to a resource, such as an API call or digital asset.

- The server replies with HTTP 402 Payment Required, including payment parameters (amount, token, blockchain, recipient address).

- The client’s wallet or agent executes the payment and generates a verifiable payment payload.

- The client retries the request, including a

X-Paymentheader with the signed transaction details. - Once the server verifies the payment, either directly or via a facilitator, it returns HTTP 200 OK, delivering the resource.

This sequence keeps the entire transaction flow within HTTP, merging content access and payment into a single, unified protocol.

Why Does x402 Matter for Agentic Commerce?

x402 is a transformative protocol that integrates payments directly into the web, enabling seamless, automated transactions for both humans and autonomous systems. Traditional payment methods often involve friction, intermediaries, or manual intervention, limiting efficiency for micropayments, API access, or machine-driven commerce.

x402 addresses these limitations by leveraging the HTTP protocol itself: when a resource requires payment, the server issues a “402 Payment Required” response containing precise payment instructions. The client can then complete the transaction, verify settlement, and access the resource automatically. Compatible with stablecoins such as USDC, x402 provides a secure, scalable, and standardized framework for value exchange.

By making financial transactions as straightforward as data requests, x402 establishes a foundation for the next-generation web, supporting both human users and agentic commerce in a more efficient and reliable manner.

Difference between x402 and traditional payment APIs.

As digital commerce evolves, especially with AI agents and autonomous systems becoming more common, the way payments are handled is shifting. x402 is a protocol-level solution built into the web itself, while traditional payment APIs like Stripe or PayPal rely on external platforms. The table below highlights the key differences:

| Feature | x402 | Traditional Payment APIs (e.g., Stripe, PayPal) |

| Integration | Embedded directly into the HTTP protocol, payment flows occur within standard web requests/responses | Operates through external APIs, SDKs, or forms outside the core web protocol |

| Target Users | Both humans and autonomous agents (AI, bots, IoT devices) | Primarily humans; automation requires custom backend logic |

| Settlement Method | Supports blockchain-based or stablecoin payments, enabling fast, global, and programmable transactions | Uses fiat banking rails (cards, ACH), which can have delays, fees, and geographic limitations |

| Automation & Micropayments | Optimized for pay-per-use, micropayments, and agent-driven transactions | Can handle small payments but usually requires additional steps and is not agent-friendly |

| Friction | Minimal; agents can pay, verify, and access resources automatically | Moderate; typically requires logins, confirmations, or human interaction |

| Primary Use Cases | Agentic commerce, AI services, APIs, IoT, microtransactions | E-commerce, subscriptions, SaaS billing, human-driven payments |

Conclusion

The 402 status code was once a placeholder, a symbol of an unfulfilled idea. Today, x402 transforms that placeholder into a powerful standard that could reshape digital commerce.

By embedding payments directly into the language of the web, x402 makes transactions faster, smarter, and more adaptive to the realities of an AI-driven economy. It’s more than a protocol; it’s a step toward a web where value moves as freely as information.